Summary

LIQ Auctions was an instant liquidity NFT auction protocol and auction house targeted towards tokenized physical collectibles.

Role

I was a co-founder and the CTO, while my co-founder Raymond Ma was CEO.

During our time working on LIQ Auctions, I was responsible for architecting, designing, and building the website. This included the UI/UX designs and architecting and building the web app frontend and backend using Next.js, Node.js, React, TypeScript, and Postgres.

Problem

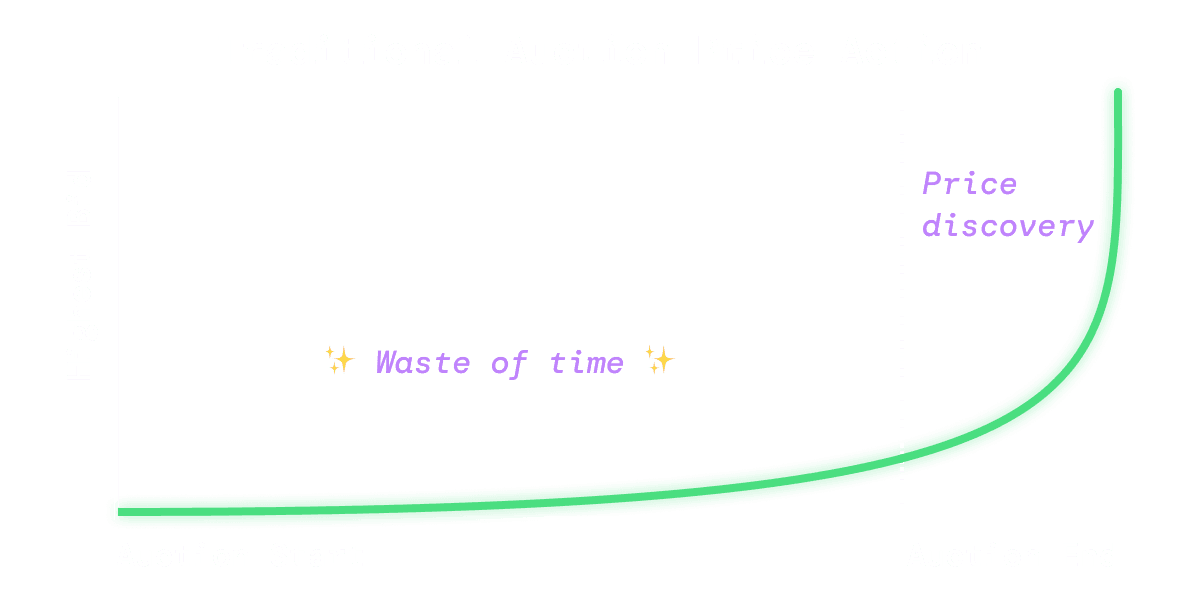

Holders of illiquid assets are often faced with a dilemma when looking for liquidity for their assets. If they need liquidity quickly, they can sell the asset for below market value or get a loan. If they are more flexible on time, they can attempt to get fair-market value for their asset through an auction house, which involves a lengthy process, high fees, and risks failed settlement at the end of the process.

Solution: The Liquid Auction Protocol

A Superior Auction Format

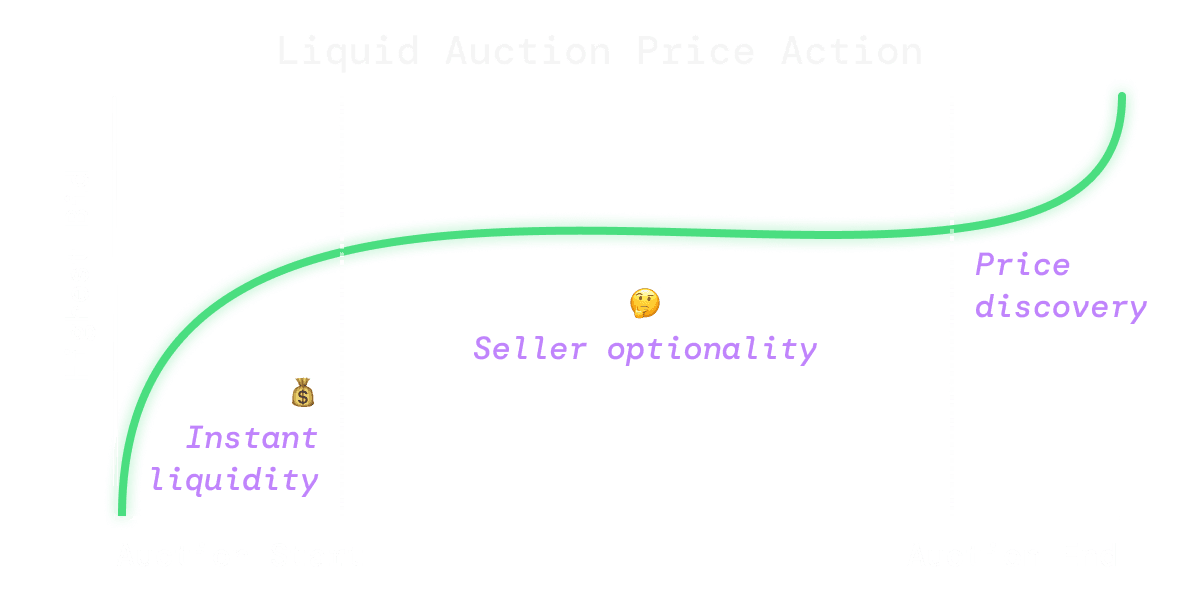

The Liquid Auction Protocol was created to facilitate a new type of auction that provides sellers with immediate liquidity, fair-market value, low fees, and guaranteed settlement.

The protocol can achieve this because of its design:

- Auction format → fair-market value

- No middlemen → lower fees

- Locked bids → guaranteed settlement

- Collateralized bids → instant liquidity

What's the downside?

If you've been paying attention, you may have noticed that this all sounds great for the seller, but less than ideal for the bidders. Because the protocol locks bids in the smart contract for the duration of the auction, bidders would be unlikely to place a bid early on — a requirement for providing sellers with instant liquidity.

Bid-to-earn

To incentivize and compensate for early bids, the protocol includes a bid-to-earn mechanism. Simply put, when bidders are outbid they are returned their original bid amount plus earn yield on their bid.

The yield is applied on the difference between the new bid and previous bid. Here's how that would play out for the first and second bid of an auction.

Bidder 1

Previous bid amount: $0

Bid amount: $100

Yield: 5%

Return if outbid: $5.00

Bidder 2

Previous bid amount: $100

Bid amount: $150

Yield: 5%

Return if outbid: $2.50

Since the first bid has the highest potential for reward, it incentivizes a bid to be placed early and relatively high, thus providing instant liquidity for sellers and maximizing yield for early bidders.

Product: Auction House

The second product of LIQ Auctions was the auction house. Like any new protocol, getting any meaningful adoption is difficult before anyone can see the mechanism in action, so we built our own auction house that uses the protocol.

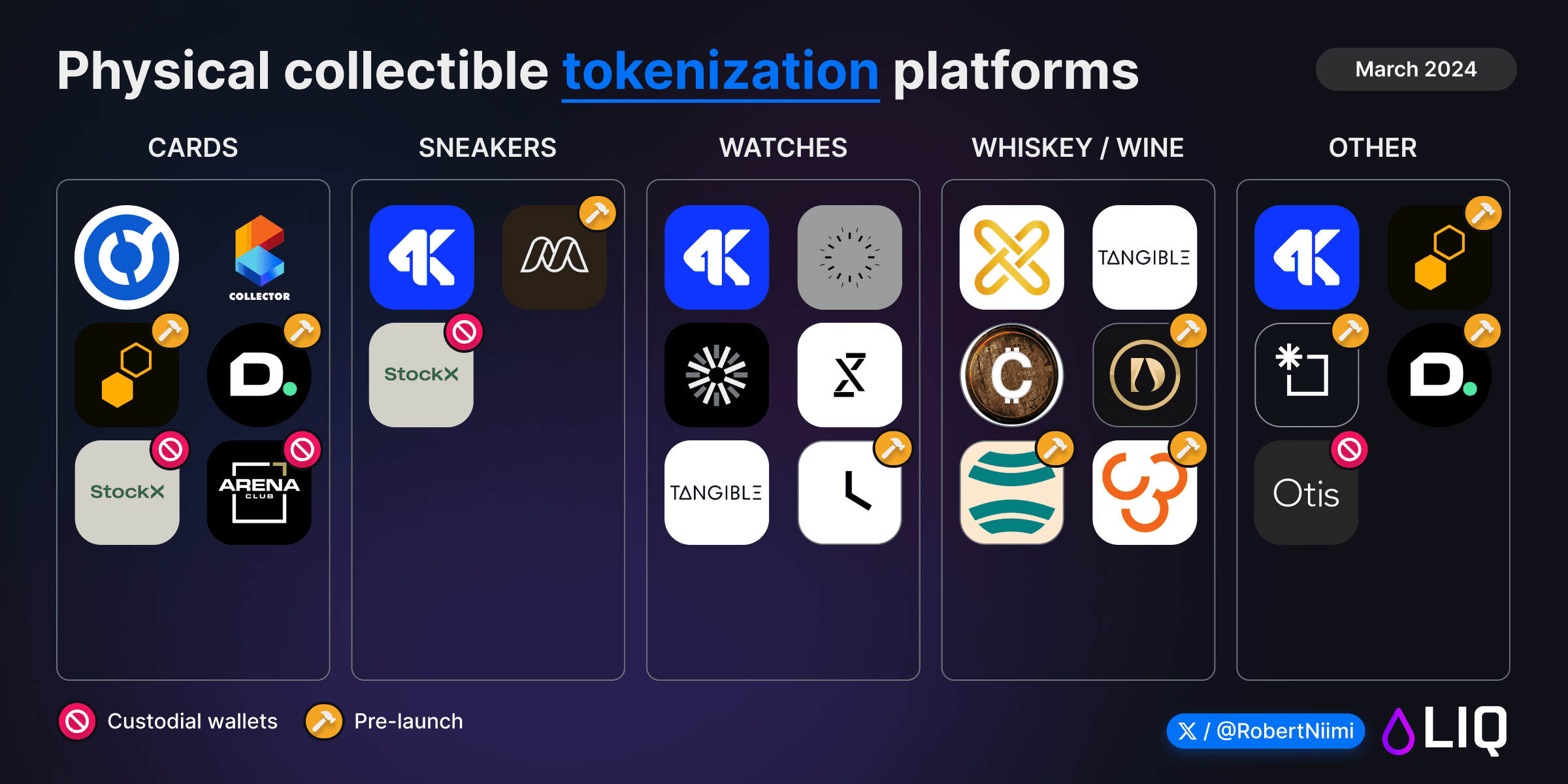

Target Market

When deciding on our initial target market, we looked across the industry. At the time, summer of 2023, tokenized physical collectibles looked like they were going to be the next big thing. They also seemed perfect for other NFT use-cases such as loans since they were physically backed by well-established assets - watches, sports cards, etc.

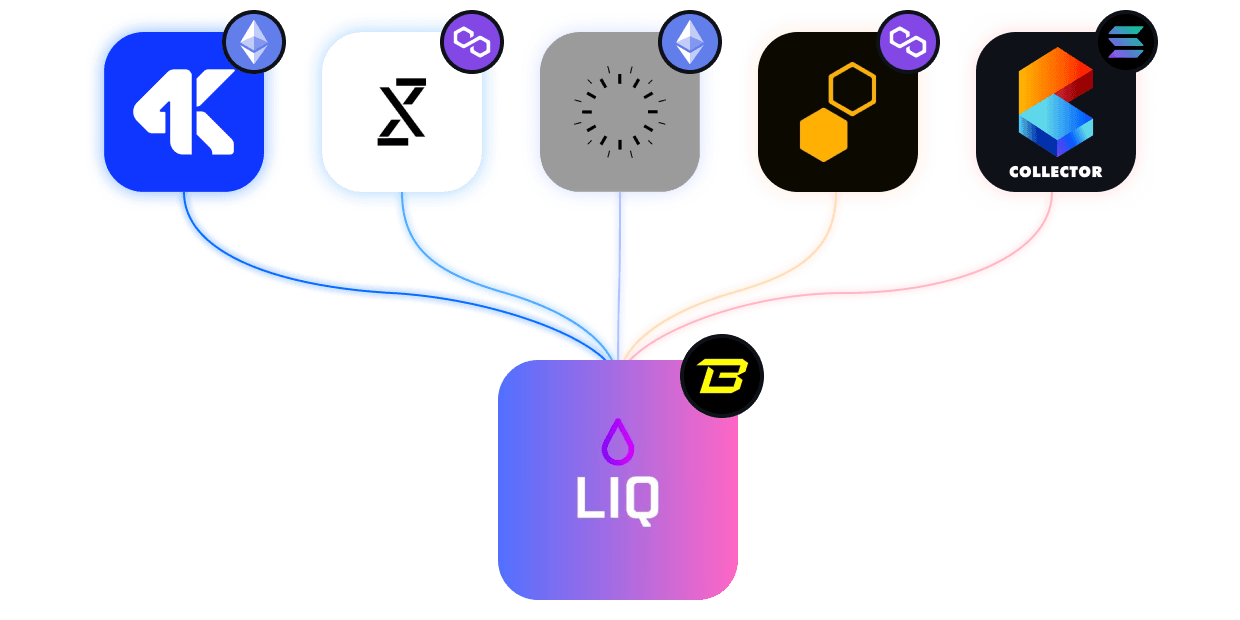

The Auction House

Our goal was to first use our auction house to demonstrate the value of the protocol, then sign up companies to use our protocol on their own applications. They would get the full Liquid Auction experience on their own site and their items would also show up on LIQ's auction house, giving them more exposure.

In order for that to happen, we had to make the auction house engaging and improve the overall auction experience for both buyers and sellers. A simple way to do that was to allow seller, creators, and hosts to interact with the bidders during the critical last moments of the auction via text, video, and audio chat — thus the roadmap was born:

- Bidder flow

- Live chat

- Seller flow ← got here

- Protocol SDK

- Live audio

- Live video

After adding the features required for the bidding flow and listing a few cheap, tokenized Pokémon cards from Courtyard.io we got our initial feedback. As we expected, users didn't fully understand how the protocol mechanisms worked until they were outbid for the first time and received their first bidder reward. But once they did a lightbulb went off, and they were hooked.

Shortly after our initial tests, I added the live text chat to replace our Discord channels using the Agora Chat SDK and we were ready for our first truly unique auction — a re-tokenized Azuki Twin Tigers jacket.

Screenshot of the Azuki Twin Tigers jacket auction with live chat.

After the auction was settled, the results were better than we had hoped. Not only were users engaged, but bizdev became much easier by showing how the auction mechanism worked. Companies wanted a similar experience for their users.

Conclusion

Towards the end of our journey, we had secured partnerships with major tokenization platforms such as 4K Protocol, Colony.xyz, and Watches.io showing demand for the product on both consumer and B2B sides.

Shutdown

If everything looked promising, why did we fail? After going through due diligence with a few VCs we received feedback that while the RWA category as a whole was growing rapidly, the tokenized physical collectibles space looked far less attractive, at least for now.

Shortly thereafter, a few tokenized collectible platforms shut down and others we had been in contact with were struggling to raise. With the platforms that we relied on struggling and our own fundraise looking grim, the writing was on the wall.

Reflection

While it clearly wasn't the outcome we wanted there were some highlights. I had gone through my first accelerator and am very thankful for getting to attend Outlier Venture's Base Camp accelerator program. The team was instrumental in connecting us with industry experts and investors, providing useful strategic and product feedback, and were more than willing to be the first users of the platform. It was also my first time building in the web3 space which, despite it's ups and downs, I'm still very bullish for various reasons. The main one being maturing UX. Platforms like Privy.io provide such a seamless experience that apps built on their platform feel like any other web2 app — essential for mass adoption.

Even though my time working on LIQ Auctions is over it may only be the beginning of my web3 journey.